Is Responsibility Insurance Coverage Required in California? Obligation insurance coverage covers crashes where you are at mistake. Does California Accept Digital Insurance Coverage Cards?

The prices revealed below are for relative functions only and ought to not be thought about "typical" prices readily available by specific insurance providers. Since automobile insurance rates are based upon private aspects, your car insurance rates will vary from the rates shown right here. low cost auto. U.S. Information 360 Evaluations takes an unbiased strategy to our suggestions.

auto prices car money

auto prices car money

insured car vans dui auto insurance

insured car vans dui auto insurance

The typical vehicle insurance coverage price in California can vary from $733 for marginal coverage to $2,065 for full coverage (cheapest auto insurance). Obtaining a precise solution is difficult without answering a lot of questions like where you live, and also your vehicle model, among others (cars). Despite every one of that, understanding the ordinary price is at the very least a great starting factor in establishing what you could have to spend.

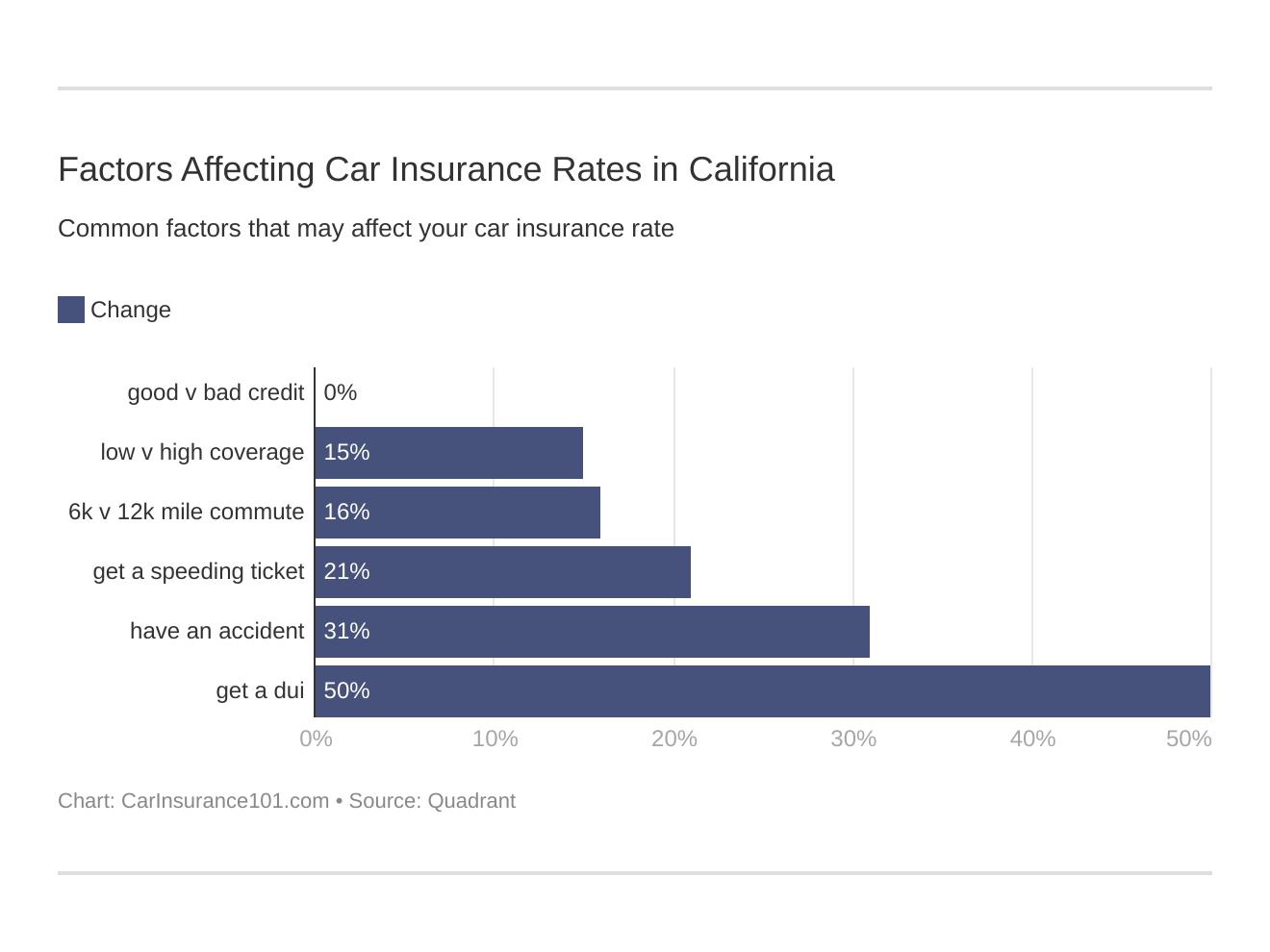

So, keeping that in mind, we'll evaluate the ordinary expense of cars and truck insurance coverage in California. Then we'll dig deeper to figure out how you can optimize your financial savings while getting the coverage you require. The Aspects that Impact Typical Cars And Truck Insurance Policy Prices in The golden state It's probably no shock to discover that not everybody pays the same prices for car insurance in The golden state.

What Does How To Find The Best Car Insurance In California - The Dough ... Mean?

As for the insurance providers are concerned, the very best are motorists who are predicted to have the fewest cases. That means they drive safely and also responsibly. On the other hand, higher-risk consumers are those that may be most likely to turn in more claims and also trigger the insurance firm even more cash. The insurance firms check out groups of individuals to figure risk based upon how others in the very same team usually behave. cheaper auto insurance.

Young guys will typically be charged much more for their auto insurance coverage than those who are older or woman. Age, sex, and marriage condition are thought about right here. insurance.

And wedded individuals are typically much safer motorists than solitary people. Some are very expensive to repair, so insurance firms bill much more for protection.

car insurance cheaper car insure auto insurance

car insurance cheaper car insure auto insurance

Exactly how do you utilize your car? If you commute daily for fars away, you can probably expect to pay more for your policy than if you just placed a couple of thousand miles a year on the odometer. It might not seem fair, but you're most likely to pay more for your protection if you have a poor credit history.

The Main Principles Of Blue Shield Of California - California Health Insurance

You can likewise choose to take just marginal coverage as mandated by your state. That would certainly be liability insurance coverage, which we'll explain later. Average Annual Vehicle Insurance Expense in The golden state As you can see, there are a great deal of variables that will certainly influence the expense of cars and truck insurance policy in California for you.

However here's the average yearly vehicle insurance policy rates in California in 2021 for basic Check out the post right here support. Complete protection: $2,065 Marginal coverage: $733 What Minimal and Complete Protection Insurance Way The most effective explanation of those terms is that complete insurance coverage uses the very best economic protection. Minimum coverage offers the least pricey level of vehicle insurance coverage that each state will certainly enable a vehicle driver to have.

This is called responsibility protection. If you was accountable for a crash that harmed another chauffeur and harmed a car, your insurance would compensate to a particular dollar amount for the injury and also damage to the various other vehicle. Yet you would certainly not be able to turn in a claim for the damage to your very own car.

Driving a lorry means having automobile insurance, since in California it's a need (business insurance). The golden state does not play games when it concerns driving and staying insured. There are lots of vehicle insurance policy suppliers using great deals of various choices that fulfill or surpass the state needs considering that there are numerous chauffeurs to insure.

Commercial Auto Insurance Cost - Insureon Things To Know Before You Buy

auto insurance car insured business insurance dui

auto insurance car insured business insurance dui

Typical Price for Minimum Automobile Insurance Needs in The Golden State, The golden state, like nearly all other states, has actually created state laws that mandate automobile proprietors should have a certain level of auto insurance coverage (insured car). If you're driving in The golden state, you are legally required to have insurance coverage and also the policy information ought to be in the car with you - low cost.

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png) auto cheaper cars business insurance dui

auto cheaper cars business insurance dui

The Zebra crunched the auto insurance coverage prices and also identified $573 was the yearly average for responsibility coverage only in California. Worth, Penguin has the highest possible annual average of $617 for minimum coverage. Given that data, it's safe to say automobile insurance coverage will set you back around $550 a year or more if you opt for added coverage. * Fees legitimate since the writing of this article (insurance).

Ordinary The Golden State Car Insurance Coverage Prices Beyond the Minimum, If you reside in The golden state you won't be too stunned to find that the annual expense of automobile insurance is 20% higher generally compared to various other states. car insurance. That's thinking about all 27 million California chauffeurs, many of which select to obtain auto insurance protection beyond the minimum needed amounts (vehicle insurance).

The Zebra approximates the ordinary annual costs for California auto insurance coverage is $1,713 a year. A whole lot of factors go into the price of a vehicle insurance costs (vans).